On May 28, Manbang Group submitted an application for an IPO in the United States to the US Securities and Exchange Commission. It plans to be listed on the New York Stock Exchange under the stock code "YMM". The underwriters are Morgan Stanley, CICC, Goldman Sachs, etc. Softbank and Sequoia, as the company's major shareholders, accounted for 22.2% and 7.2% of the equity before the IPO, respectively.

On May 11, Manbang Group was rumored to be planning to submit a US IPO application soon, and it was able to raise approximately US$1.5 billion through the IPO, with a valuation between US$20 billion and US$30 billion. Man Gang responded with "no comment," and now the hammer tone is finally settled.

Yunmanman and Truckbang received nearly 15 rounds of financing before and after the merger, Manbang IPO has a foreboding

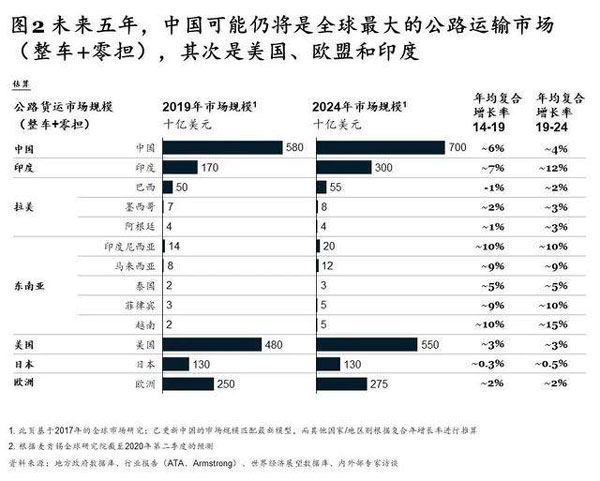

China's large-scale road freight market has brought business needs and room for survival to Manbang.

On December 15, 2020, McKinsey, a global management consulting company, issued an article analyzing the current situation of China's road freight market. According to the McKinsey report, my country's road freight market ranks first in the world, with a total market size of approximately RMB 5.5 trillion in 2019. At the same time, it predicts that China may still be the world's largest road transportation market in the next five years.

In 2017, Yunmanman merged with Truckbang to form Manbang Group, which became a high-profile merger in the logistics field. Prior to this, Yunmanman and Truck Gang both occupied the advantageous resources of truck-to-cargo matching in the logistics industry.

According to public information, the company was established in 2013 and has received 8 rounds of financing as of September 2017, with a valuation of over 1 billion U.S. dollars. The platform's real-name registered heavy truck drivers are about 4 million, and the shippers are about 900,000. The daily transaction waybill is 25. Ten thousand orders; the truck gang, established in 2011, had 880,000 vehicles registered as members with integrity as of the end of July 2017, and facilitated 140,000 orders per day.

The market resources brought by the merger of the two to Manbang are distinct. The new group company retains the original Yunmanman and Wagonbang brands and continues to operate independently. IiMedia Consulting CEO Zhang Yi analyzed in an interview with Blue Whale that Manbang has a certain amount of marketing scale, which is enough to support its relatively good market value, which is one of the key factors for listing. In addition, he also pointed out that the maturity of capital has boosted its listing.

On April 24, 2018, Manbang announced the completion of the first round of financing after the merger. The investment was jointly led by Guoxin Fund and Softbank Vision Fund, with a financing amount of US$1.9 billion and a valuation of US$6.5 billion. According to relevant data from the Prospective Industry Research Institute, Yunmanmanhe Truck Group has experienced about 13 rounds of financing before, with a financing scale of hundreds of millions of dollars.

In 2017, Yunmanman merged with Truckbang to form Manbang Group, which became a high-profile merger in the logistics field. Prior to this, Yunmanman and Truck Gang both occupied the advantageous resources of truck-to-cargo matching in the logistics industry.

According to public information, the company was established in 2013 and has received 8 rounds of financing as of September 2017, with a valuation of over 1 billion U.S. dollars. The platform's real-name registered heavy truck drivers are about 4 million, and the shippers are about 900,000. The daily transaction waybill is 25. Ten thousand orders; the truck gang, established in 2011, had 880,000 vehicles registered as members with integrity as of the end of July 2017, and facilitated 140,000 orders per day.

The market resources brought by the merger of the two to Manbang are distinct. The new group company retains the original Yunmanman and Wagonbang brands and continues to operate independently. IiMedia Consulting CEO Zhang Yi analyzed in an interview with Blue Whale that Manbang has a certain amount of marketing scale, which is enough to support its relatively good market value, which is one of the key factors for listing. In addition, he also pointed out that the maturity of capital has boosted its listing.

On April 24, 2018, Manbang announced the completion of the first round of financing after the merger. The investment was jointly led by Guoxin Fund and Softbank Vision Fund, with a financing amount of US$1.9 billion and a valuation of US$6.5 billion. According to relevant data from the Prospective Industry Research Institute, Yunmanmanhe Truck Group has experienced about 13 rounds of financing before, with a financing scale of hundreds of millions of dollars.

In September 2019, Manbang Group CFO Zhang Yuansheng revealed in an interview with foreign media that the company is considering an IPO due to its good financial situation, but has not yet determined the final timetable, and has not yet determined whether to continue in the first level before the IPO. A new round of financing in the market.

On November 24 last year, Manbang announced the completion of a new round of financing of approximately US$1.7 billion, with 13 institutions including Tencent Investment, SoftBank Vision Fund, Sequoia Capital and Hillhouse Capital participating in the investment. The merged Manbang has shown more obvious business growth after undergoing multiple rounds of financing. In this round of financing, Manbang will focus on technological innovation, service innovation and model innovation. On the one hand, it will increase R&D investment to consolidate and enhance the technical barriers of the intelligent matching system; on the other hand, it will further extend the service scope of the highway arterial market and make an all-round entry. In the field of intra-city freight, we provide users with door-to-door, one-stop freight services.

According to the latest prospectus, in the first quarter of 2021, Manbang achieved revenue of 867 million yuan, a year-on-year increase of 97.7%; non-US GAAP net profit reached 113 million yuan, a year-on-year increase of 324.4%. Manbang’s 2020 annual GTV (total platform transaction volume) reached 173.8 billion yuan, the order volume reached 71.7 million orders, the revenue was 2.58 billion yuan, the gross profit margin reached 49%, and the non-US GAAP net profit was 281 million yuan. .

Zhang Yi believes that in terms of the capital return cycle, several rounds of financing in history have reached the moment of capital launch, and capital is in a period of high attention and research in the field of travel. At this time, listing is easy to be accepted by capital. In an interview with Blue Whale, automobile analyst Zhang Xiang also said that the participation of major shareholders such as Tencent and Softbank has brought a good corporate endorsement to Manbang.

Compared with Huolala's intra-city freight, Manbang helps cargo owners and drivers quickly conclude transactions in the field of inter-city freight, forming a more obvious advantage. In Zhang Yi's view, Manbang’s business model is very important to solve the phenomenon of one-way full load of trucks and no return on the return journey. The rigid demand is strong. At the same time, the passenger unit price is relatively high, which is closely linked to social and economic growth.

Manbang, which is seeking to go public, has also set its sights on intra-city freight after financing in November last year.

New player Didi enters the game, old player Huolala is exposed to the market, and the same city freight battle is fierce

The iResearch research report shows that from 2014 to 2019, my country's intra-city express delivery volume increased to 11.04 billion pieces, and the domestic intra-city freight market scale has also grown from 800 billion yuan to 1.3 trillion yuan. The trillion-level market attracts more Enterprise entry.

In April last year, Didi began to enter the same city freight, invested 100 million yuan to establish a freight company, and launched Didi Freight on June 23 in Chengdu, Hangzhou and other places. In August of the same year, Manbang acquired provincial and provincial return trucks in the same city freight field. According to public information, the business scope of provincial and provincial return trucks has covered 156 cities, and its coverage rate in the logistics industry in Guangdong is 90%. In November, Manbang entered the intra-city freight market under the brand "Yunmanman".

While Manbang and Didi are extending their business, intra-city freight giant Huolala ushered in a new round of financing.

In December 2020, Huolala announced the completion of Series E financing with a financing amount of US$515 million. In January 2021, Huolala announced another F round of financing with a financing amount of US$1.5 billion.

According to public information, as of March 2021, Huolala's business scope has covered 363 cities in mainland China, with an average monthly active driver of 580,000 and a monthly active user of 7.6 million. It is worth mentioning that Huolala was also revealed in April this year that he planned to go to the US for an IPO, with a valuation of at least US$30 billion.

Huolala once said that previously, Huolala's intra-city freight was mainly for the moving market, which was a low-frequency demand, while the long-distance freight business for B-end users was just in demand and high-frequency. Under the new ecology, Huolala can cover more business scenarios.

In the process of transforming from the B-end market to the C-end, Manbang, who previously focused on the B-end market, is still facing the challenge of its rivals. Cargo Lala, which has developed mature freight business in the same city, has begun to lay out new scenes. In addition, it is not only the freight platform that competes for the market.

In October last year, after SF Express launched the "Truck Navigation", and in December, its subsidiary Tianjin Yuanheli Technology Co., Ltd. obtained the "Internet Freight" license and the freight market pass. As Zhang Yi pointed out, e-commerce platforms and powerful logistics companies, including railways and airplanes, all have advantages to compete for the market, so the competition should be very fierce.

The freight platform, which has become the new favorite of the capital market, has gradually exposed its problems during the fierce battle, and players who are eager for IPOs are facing regulatory challenges.

There are thousands of complaints from Manbang, and 8 departments have jointly interviewed the platform defects

On May 14, 8 departments including the Ministry of Transport and the Office of Cyberspace Affairs jointly interviewed 10 transportation platform companies including Manbang and Huolala.

The interview pointed out that some freight platforms, especially Manbang Group and Huolala Company, have outstanding problems such as unreasonable pricing mechanism, unfair operating rules, irregular production and operation, and failure to implement main responsibilities. Some of the platform operations are suspected of infringement. The legitimate rights and interests of truck drivers. Therefore, each platform company is required to face up to its own problems, earnestly implement the main responsibility of the enterprise, and immediately carry out rectification.

Recently, a truck driver reported on the Black Cat complaint platform that his order on May 17 was deducted in a disguised form.

He pointed out that the owner of the goods was unable to load the goods due to the unevenness of the goods, so he agreed to pay 200 yuan for the shorting cost. However, it is required to modify the order agreement to pay on full shipment and change it to freight. This results in 200 yuan not being received after the itinerary track is not available, and it will be automatically returned to the owner when the time is up. After the full customer service phone communicated with the owner, he said that the owner did this deliberately and did not want to pay the shortfall fee.

Regarding such operating rules, the driver questioned: "Why can't such a bad cargo owner be punished or given a title for shipping a full platform? Knowing that the cargo owner intends to take advantage of the loopholes and deduct the driver's freight in disguise, he does not take measures and deliberately indulges!"

Similar problems are not isolated cases. There are also many complaints from the established intra-city freight platform represented by Huolala. On the Black Cat Complaint Platform, there were 5574 complaint cases with the key word "Cargo Lala", and 1,611 complaint cases with the key words "Yuan Man Man" and "Truck Gang".

According to a research report released by the China Automotive Digital Research Institute, transporters’ satisfaction with the actual use of the online freight platform is very low, and the integrity service system of the online freight platform is not sound, and there is no good guidance on the freight rate. The owner and the actual transportation The critics have mixed opinions on it.

"If the platform mechanism is set unreasonably, it will lead to unfair distribution, and under the stimulation of such rules, drivers' one-sided pursuit of efficiency may cause harm to their physical and mental health." In Zhang Yi's view, from the current interview In terms of the situation, these rules have major flaws, causing social dissatisfaction, which is both a risk and the biggest shortcoming of an enterprise.

Zhang Xiang pointed out that problems such as unreasonable pricing mechanisms and unfair operating rules are common problems in the freight industry. This is because in the early days, simple and rude methods were used to grab resources to form scale. When the mode of burning money reaches a certain scale, the government will intervene in management at this time.

In addition, because freight logistics is an economic artery, its high dependence on the economy will bring certain uncertainty and fluctuations. Zhang Yi believes that Manbang’s future performance will be directly proportional to the increase or decrease in economic development. When the economy slows down, there are risks of fluctuations in marketing profits and market value for Manbang.

Therefore, it is not easy for companies to maintain long-lasting and safe operations in terms of operating rules, platform security, and capital protection.

Nevertheless, in Zhang Xiang's view, the freight platform is currently in the development stage and the market space is still relatively large. It will take a long time to integrate the resources of the freight company. He believes that the pattern of the online car-hailing market has basically taken shape. Compared with the undecided pattern of the freight market, the opportunities for full help are greater than the challenges, and the next five years should be in a state of relatively steady growth.

Behind the capital support, Manbang still needs to be prepared to face many challenges when it realizes its IPO dream.

ZHITONG PIPE VALVE TECHNOLOGY CO.,LTD , https://www.ztpipevalve.com