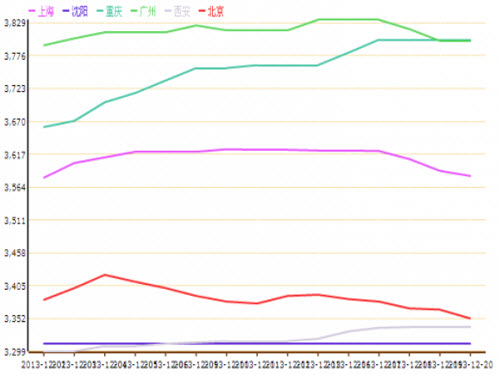

This week, the overall trend of the domestic steel market showed a steady decline in the polarization of the board and the polarization adjustment. As of December 20, the average price of the 6.5mm high line in major cities was 3,538 yuan, down 9 yuan/ton from the last day of last week; the average price of 25mm HRB400 rebar was 3,586 yuan, down 19 yuan/ton from the last day of last week; 20mm plate average price 3526 yuan, compared with the last day last week rose 14 yuan / ton; 4.75mm hot coil average price 3496 yuan, compared with the last day last week rose 1 yuan / ton; 1.0mm cold rolled coil The price of 4,316 yuan was 7 yuan less than the last day of last week.

This week, the overall trend of the domestic steel market showed a steady decline in the polarization of the board and the polarization adjustment. As of December 20, the average price of the 6.5mm high line in major cities was 3,538 yuan, down 9 yuan/ton from the last day of last week; the average price of 25mm HRB400 rebar was 3,586 yuan, down 19 yuan/ton from the last day of last week; 20mm plate average price 3526 yuan, compared with the last day last week rose 14 yuan / ton; 4.75mm hot coil average price 3496 yuan, compared with the last day last week rose 1 yuan / ton; 1.0mm cold rolled coil The price of 4,316 yuan was 7 yuan less than the last day of last week. I. Economic expansion slows down. Next year, the economy is still under downward pressure. 1. The economic development roadmap in 2014 determined to resolve the capacity and prevent local debt risks: “In 2014, two 'R's will dominate the economic process in China. The first one is Reform ( (Reform); The second is Risk.†Tao Dong, chief economist at Credit Suisse, said before the Central Economic Work Conference. From the contents of the conference, the two tasks of economic work next year are to advance reforms and prevent risks, so as to determine the tone for stability and progress.

2. The economy will still have downward pressure next year. Macro-control will shift to long-term stability: The Central Economic Work Conference will be held in Beijing from December 10 to December 13. From the public statements of the meeting, it can be seen that high-level officials still have some concerns about economic growth. The meeting stated that “downside pressures exist in economic operations.†According to analysis, under this background, the GDP growth target announced early next year may be equivalent to this year. .

3. Economic expansion slowed HSBC manufacturing PMI to a three-month low: HSBC’s data released yesterday showed that China’s manufacturing PMI forecast fell to 50.5 in December, the lowest in three months, ending in November. The value is 50.8. The initial value of China's manufacturing output index was 51.8, the lowest in two months.

4. Ministry of Commerce: The export situation in December is not too optimistic in the future. In response to the rapid growth of foreign trade in November, the Ministry of Commerce spokesman Shen Danyang stated at the regular press conference on the 18th that it was mainly under this year. The effect of the steady growth of China's foreign trade policies over the past six months and the recent improvement in the economic situation at home and abroad have resulted in the superposition of factors. Exports are expected to maintain relatively good momentum in December, but they should not be too optimistic.

5. QE shrinks Shibor and increases the central bank’s calm short-term response: In the early hours of yesterday, the Fed announced the last FOMC meeting in the year, keeping the 0-0.25% interest rate level unchanged, and at the same time reducing the purchase scale of US$10 billion a month. This means that the Fed will start to reduce the purchase of $85 billion a month to $75 billion a month from January next year, and its purchases of Chinese bonds and guarantee securities will each shrink by $5 billion. A number of professionals told reporters that the psychological impact of QE's exit on the Chinese market is greater than the actual impact.

6.Ministry of Industry and Information Technology: Resolving overcapacity and dysentery must go through three barriers: Miao Miao, Minister of Industry and Information Technology, told the Xinhua News Agency on the 19th that the three barriers that must be overcome to resolve the problem of overcapacity must be eliminated: clarifying the boundary between the government and the market, strengthening The hard constraints of environmental protection, safety, and other standards enhance the company's technological innovation and management innovation capabilities.

II. Effectiveness of environmental remediation began to play a decisive three consecutive reductions in crude steel production The China Steel Association data show that in early December, the key steel enterprises produced 1,695,100 tons of crude steel per day, which fell by 0.81% compared to the previous period. The estimated daily crude steel output of the country was 2.0129 million tons. It was down by 3.7% from the previous month. This is the beginning of mid-November, China's crude steel production has tripled, and continuous two days of crude steel production is below 2.1 million tons per day. This is the first time since April this year, the more obvious decline has occurred.

According to data from the China Iron and Steel Association, as of the end of December, steel stocks of key steel enterprises were 13,211,300 tons, an increase of 1.99% from the end of the previous ten-year period and an increase of 2.21% from the end of November.

From this point of view, on the whole, although crude steel production is still at a relatively high level, from the crude steel data of the recent ten days, environmental protection improvement has already begun to exert results. However, at the same time, it also noted that the overall inventory of steel is still high, which will obviously hinder the rebound of steel prices in the short term.

Third, the tepid transaction of raw materials and more weak and stable consolidation This week, the mainstream of the domestic raw material market into the steady consolidation operation, which billet prices fell, scrap slightly up. The billet market is subject to more downstream procurement of billet on demand, and the wait-and-see attitude is increasing, the transaction is relatively weakened, new orders are also less, this week, the trend of more steady decline; while the southern billet market in the downstream billet procurement slowdown , Market confidence is not enough, businesses offer slightly loose. In addition, at the end of the year, part of the financial pressure is very high, coupled with the lack of confidence from the downstream and the market, and the market transactions are tepid. It is expected that the trend of short-term billet will continue to be weak and stable.

Iron ore market: Since the middle of this month, since the middle of this month, Hebei Province, Hebei area, steel production cuts phenomenon is more serious, Puyang, New gold and other major steel mills to reduce production capacity by half, the environmental protection and emission reduction policies continue to increase, make Local brokers have a strong wait-and-see attitude and low market activity. Domestic mines are affected by this, and market sentiment is not optimistic. Fortunately, the rigid demand of some steel mills still exists, coupled with the current tightness of some domestic market mineral resources, so this week's steel There has been no noticeable change in prices. Considering that it is difficult for the domestic ore mining market to materially improve in the short term, and high-priced transactions are more difficult, it is expected that the short-term domestic mines will tend to be weak. However, in the current period, the current price difference of imported minerals has basically disappeared. Under the circumstances that market enthusiasm is weakened, especially in terms of port spot prices, more and more low-cost resources will become available over time. The pressure on the market is generally greater, and the slow down trend is difficult to change. .

Fourth, the downstream demand is difficult to have a good performance The steel market will continue to supply more than demand With the gradual cold weather, the northern construction industry is almost shut down, the southern construction industry operating rate is also declining, the downstream demand has not been a better performance, the overall Looking at the steel market will continue to be in a pattern of oversupply for a long time, and there will be insufficient power for continued steel price growth in the latter period.

In addition, the new urban plan for China, which has high hopes for the market, is expected to be formally introduced and will be officially implemented in 2014. Therefore, in the process of promoting urbanization, real estate, infrastructure, etc. will generate a large amount of new demand for building materials, and the market is expected to improve significantly; but urbanization stimulus will undoubtedly boost demand next year, but it will affect the steel market in the short term. It is still very limited, and the funding problem for new urbanization is still a big problem.

V. Baosteel Wuhan Iron and Steel raised its policy in January to drive other manufacturers' policies to increase. That is, last week, Baosteel and Wuhan Iron & Steel announced a steady increase in plate policies in January 2014. This week, Anshan Iron and Steel, Shougang, Heavy Steel, and Bagang are the plate manufacturers. Policies have also been introduced one after another, mostly based on a steady increase of 30-50. And other Liuzhou Iron and Steel, Ansteel and other plate manufacturers policy also appeared ranging from 30-50 small rise. The policy of building materials manufacturers has been steadily lowered. Among them, Pingliang Steel, Baotou Steel, New Steel, Hubei Iron and Steel Corporation, and the 2672 Factory and other manufacturers' building materials policies have been lowered by 10-60. As a whole, the recent policy of plate manufacturers to increase stability, supporting the spot market price of the plate also showed a steady rise in shocks and rising adjustments. The steady decline in the policy of building materials manufacturers has stimulated the trend of the building materials spot market to adjust with steady declines.

In summary, China Steel Net believes that due to the current slowdown in economic expansion and the expected downward pressure on the economy next year, coupled with the near-term terminal demand will become more and more light, and the oversupply of the steel market in the With the increase, the pressure for the short-term steel price to continue falling will increase. Fortunately, in January of next year, the policy of first-line plate manufacturers has increased steadily, and with the increase in environmental protection inspection, there is still room for decline in crude steel production. This supports the firm operation of some steel prices in the later period. As a whole, due to the recent shortage of resources in the market has arrived one after another, and the return of capital at the end of the year will also increase pressure, so under the current situation of increasing pressure on steel prices, it is expected next week steel prices will enter the steady shock down Adjustments, however, do not rule out that some sheet prices continue to rise slightly due to shortages.

Reflective Warning Sign,Reflective Warning Sign For Road Use

Daoming Optics & Chemical Co., Ltd , https://www.reflectives.nl