2011 was a year of soaring international oil prices. The turmoil in the geopolitical situation in the Middle East and North Africa, especially the suspension of Libya’s oil exports, has caused the international market to worry about crude oil supply shortages, which has pushed up oil prices. Statistics show that in 2011, the average oil price of the Organization of Petroleum Exporting Countries (OPEC) reached US$107 per barrel, a record high and about 14% higher than the previous record in 2008.

2011 was a year of soaring international oil prices. The turmoil in the geopolitical situation in the Middle East and North Africa, especially the suspension of Libya’s oil exports, has caused the international market to worry about crude oil supply shortages, which has pushed up oil prices. Statistics show that in 2011, the average oil price of the Organization of Petroleum Exporting Countries (OPEC) reached US$107 per barrel, a record high and about 14% higher than the previous record in 2008. Since 2012, international oil prices experienced a sharp decline in the second quarter after experiencing a surge in the first quarter, but they regained their upward momentum in the third quarter. According to the latest report of OPEC, in the first three quarters of this year, the average oil price of OPEC was US$110.18 per barrel, which was slightly higher than the US$107.31 of the same period of last year, which was a year-on-year increase of 2.67%.

Although the Middle East is a world oil depot, the distribution of crude oil reserves in the region is very uneven. Saudi Arabia, Iran, Iraq, Kuwait, UAE, Qatar and other countries have rich crude oil reserves and are the world’s most important crude oil exporters. However, crude oil reserves and production in countries such as Egypt, Morocco, Morocco and Jordan are limited. Crude oil is imported every year to meet domestic demand.

According to the latest World Economic Outlook report published by the International Monetary Union (IMF), the major oil exporting countries in the Middle East have experienced high oil prices. Last year's economic growth rate reached 3.9%, and this year it is expected to reach 6.6%. Among them, Saudi Arabia’s economic growth rates in 2011 and 2012 were as high as 7.1% and 6% respectively; Qatar’s economic growth rates were respectively 14.1% and 6.3%; and UAE’s economic growth rates were 5.2% and 4%, respectively. The economic growth rate of oil importing countries in the Middle East was only 1.4% last year and is expected to slow further to 1.2% this year. Among them, Egypt's economic growth rates in 2011 and 2012 were 1.8% and 2%, respectively; Morocco's economic growth rate this year has sharply slowed from 4.9% last year to 2.9%.

From the oil revenues of countries in the Middle East region, we can see the different impact of the soaring international oil prices on the economies of different types of Middle Eastern countries. Last year, Saudi Arabia’s oil export revenues reached US$302.3 billion, a 40% increase from the US$215.5 billion in 2010, and a net increase of US$86.8 billion. The UAE’s oil export revenue last year was 111.6 billion U.S. dollars, a net increase of 37 billion U.S. dollars from the previous year’s figure of 74.6 billion U.S. dollars, an increase of about 50%. Last year, Kuwait’s oil export revenue was 100.8 billion U.S. dollars, an increase of 39.1 billion U.S. dollars from the previous year's 61.7 billion U.S. dollars, an increase of 63%.

In contrast, Middle East oil importers pay higher prices for higher oil prices. Last year, Egypt’s oil imports amounted to more than 7.8 billion U.S. dollars, an increase of nearly 2.7 billion U.S. dollars from the previous year’s 5.16 billion U.S. dollars, an increase of more than 50%. Jordan’s oil imports amounted to 5.2 billion U.S. dollars, which was also more than half of the previous year’s figure of less than 3.5 billion U.S. dollars. Last year's oil import expenses in Morocco and Morocco increased by 36% and 28% respectively compared with the previous year.

Judging from the situation this year, the economy of the Middle East’s oil exports and imports will continue to show polarization. According to the IMF's forecast, this year Saudi Arabia’s oil export revenue will reach nearly 351 billion U.S. dollars, UAE’s oil export revenue will reach 122 billion U.S. dollars, and Kuwait’s oil export revenue will reach 120 billion U.S. dollars, up 16%, 9.5%, respectively, over the previous year. 19%. It is estimated that Iraq’s oil export revenue this year will soar by more than 20% from last year. Only Iran’s sanctions against western countries are expected to reduce oil export revenue by about 18% from last year.

The oil-importing countries in the Middle East will pay a higher price than last year for high oil prices. Among them, Egypt’s oil import spending will increase by 1.35 billion U.S. dollars over the previous year, and Morocco’s oil import expenditure will increase by 1.3 billion U.S. dollars.

According to the IMF's forecast, despite the existence of many uncertainties, the decline in international oil prices next year may be significantly higher than the rise due to the impact of the global economic growth rate forecast. Affected by this, the economic growth rate of oil exporting countries in the Middle East is expected to slow down to 3.8% next year, while the economic growth rate of oil importing countries will increase to 3.3% due to the drop in oil prices and the stabilization of the political situation.

Naipu WS dredging pump is single-stage single-suction cantilever horizontal centrifugal pump with advantages of light weight ,good wear-resistant ,super dredging performance ,perfectly suited for the dredge on the whole construction ,high multiple economy benefits and so on .It throughout meets requirements of the dredge to dredging pumps .The pump mainly consists of the pump head , gearbox specifically for the dredging pump ,high elastic coupling and supervisor system of the driving device for the dredge.

Typical Applications---

Suction Hopper Dredging

Constructional Material

Sand gravel processing

Barge Loading

Sand Reclamation

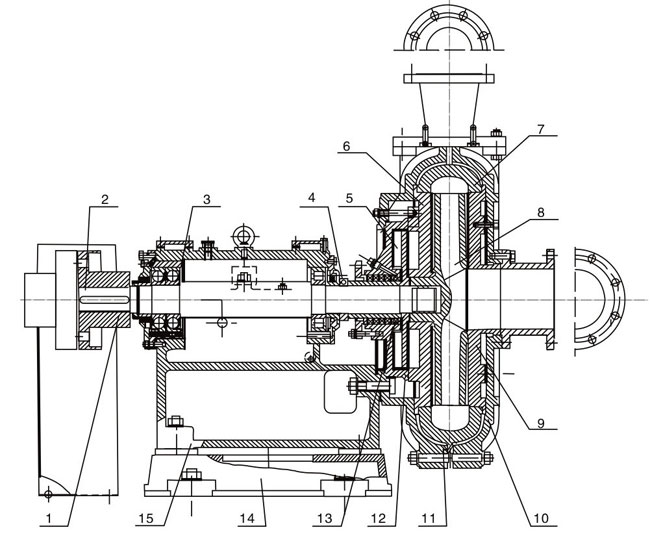

WS Dredging Pump Construction Drawing

Main Part Number At The Drawing

|

1 – Shaft

2 – Frame 3 – Mechanical Seal Assembly 4 – Connecting Plate 5 – Rear Liner |

6 – Pump Casing

7 – Cover Plate 8 – Front Liner 9 – Impeller 10– Support |

Materials of Construction

|

|

VOLUTE |

IMPELLERS |

BASE |

EXPELLER |

EXPELLER RING |

SHAFT SLEEVE |

SEALS |

|

Standard |

High Chrome Alloy |

High Chrome Alloy |

Cast Iron |

Chrome Alloy |

Chrome Alloy |

SG Iron |

Natural Rubber |

|

Options |

SG Iron |

SG Iron |

Mild Steel |

SG Iron |

SG Iron |

EN56C |

Nordel |

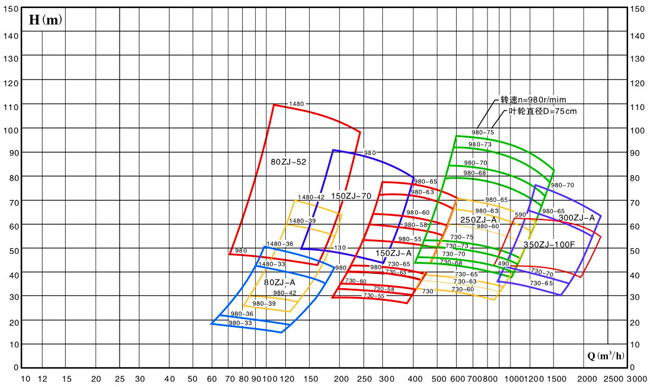

WS Dredging Pump Selection Chart

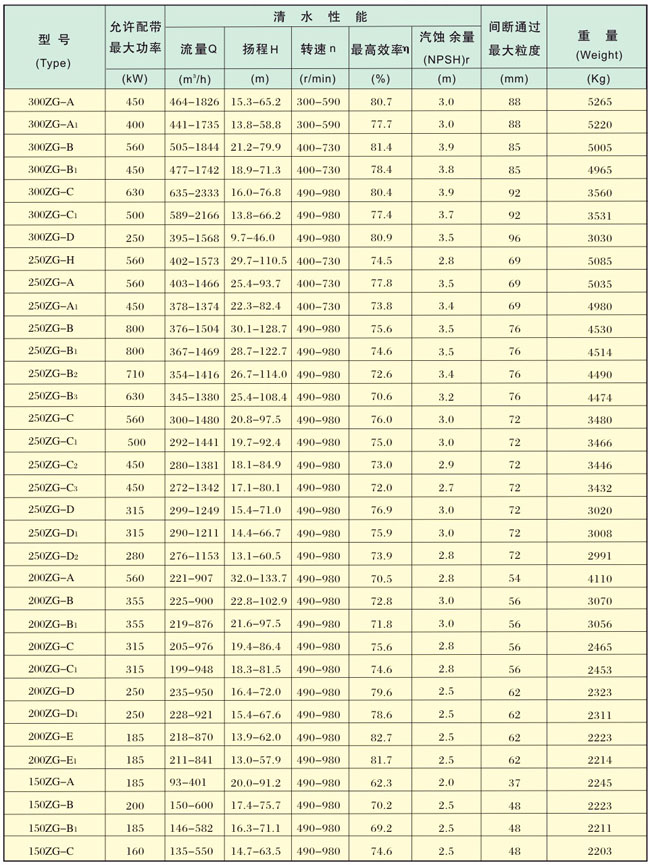

WS Dredging Pump Performance Parameters

Dredging Slurry Pump,River Sand Dredging Pump,Submersible Dredging Pump,Horizontal Dredging Pump

Shijiazhuang Naipu Pump Co., Ltd. , https://www.naipu-pump.com